Investing in Japanese equities

How is Japan evolving against the backdrop of a changing economy, the pandemic and climate change?

The Japanese equity market is very closely linked with the performance of the global economy, and the pace of the recovery is presently being underestimated by the market.

This presents an opportunity for investors.

Given that Japan is one of the most cyclical and open global markets, highly leveraged to the health of the world economy, investment experts believe it will be a major beneficiary of the recovery and continue to seek out opportunities benefiting from Japan’s digital reform.

With a new leader for the country and a hefty stimulus package unveiled, what does the future hold for Japanese equities?

This report is worth an indicative 30 minutes' CPD.

A clear majority of the advisers who responded to the latest FTAdviser poll prefer to get exposure to the Japanese equity market via global funds, rather than single country or regional funds.

The poll, which was conducted via Twitter, found that 70 per cent of advisers prefer the exposure to come from global funds, compared with 30 per cent who prefer the exposure to come from dedicated Japanese equity funds.

The Japanese equity market is notoriously difficult to make money from, with issues around the treatment of minority shareholders combined with a sluggish outlook for the economy, and the composition of the Nikkei index, which is to a large extent comprised of value stocks, while over the past decade growth equities have been in vogue with investors.

But as global growth picks up and the possibility of interest rate rises around the world has become central to investors' thoughts, the potential exists for a prolonged period of outperformance from value stocks relative to their growth counterparts.

In addition, successive Japanese governments have embarked on reforms with the aim of improving corporate governance and attitudes to minority shareholders, and therefore improving the equity market’s reputation and the productivity of the economy.

david.thorpe@ft.com

© Kiyoshi Ota/Bloomberg via Fotoware

© Kiyoshi Ota/Bloomberg via Fotoware

Japanese prime minister Fumio Kishida. © Yoshikazu Tsuno/Pool Photo/AP via Fotoware

Japanese prime minister Fumio Kishida. © Yoshikazu Tsuno/Pool Photo/AP via Fotoware

Japan Stock Market. © EPA/Christopher Jue via Fotoware

Japan Stock Market. © EPA/Christopher Jue via Fotoware

Human support robot at Toyota. © Kiyoshi Ota/Bloomberg via Fotoware

Human support robot at Toyota. © Kiyoshi Ota/Bloomberg via Fotoware

What does the future hold for Japan's equity market?

Just imagine it: the scene is the retirement party of a global equity fund manager.

Amid the self-deprecating jokes about leaving to spend more time with his golf clubs and how he might be back if he gets under his wife’s feet too much, he says that, having only been in the market for 30 years, 'Of course I haven’t made money from Japanese equities yet.'

His words draw a knowing look from his peers, who all recognise the truth in his remarks.

The truth is, those who seek to profit from the Japanese market are confronted with challenges around both the composition of the Nikkei index and the macroeconomic picture, despite certain Japanese companies being familiar names around the world.

Investors looking at that market often find companies that have built up vast cash balances, but also a reluctance to distribute that cash via share buybacks or dividends, leaving investors frustrated.

Meanwhile, many of the largest Japanese conglomerates own shares in each other’s businesses, making it difficult for external shareholders to exert influence, meaning corporate strategy can be slow to evolve.

At the macro level, ‘turning into Japan’ has become a shorthand used by many policy makers to describe the economic conditions they are seeking to avoid at all costs.

Since 2013, Japanese equities have outperformed relative to the big European markets, though they have underperformed against the US

Those conditions are expressed in terms of very low inflation and very low levels of economic growth, with bond prices high but equities also struggling.

Household names

The malaise can also be seen in the fate of many Japanese exporters.

Where once our shops were full of TVs and other household electrical appliances made by Japanese manufacturers, the labels now are much more likely to reveal the country of origin as Korea or Taiwan.

While the broad contours of the Japanese economic unease can be seen in the performance of the Eurozone, and, to a lesser extent, the UK, there are also uniquely Japanese factors.

These include the relatively low level of participation of women in the workforce compared with other western economies, a much older population than other developed markets, and a lack of immigration to the country.

Politicians in Japan have, over the past decade, tried to address many of those issues, and have had sufficient success that many of the market-specific reasons for Japan being in the doghouse with some investors have become “great myths”, according to Sam Perry, senior investment manager for Japanese equities at Pictet.

Government pressure

He says: “Since 2013, Japanese equities have outperformed relative to the big European markets, though they have underperformed against the US.

“But you wouldn’t own the US right now if dividends were your priority anyway, and Japanese companies are yielding around what the European ones are.”

He says successive Japanese governments have legislated to force companies to unwind stakes they own in other conglomerates, and to force those businesses to distribute more of their surplus cash to shareholders.

Perry says the pressure on companies to act has become more intense in recent years.

Everyone else catches down to Japan, rather than Japan catches up. Japan has a very conservative culture and that can hinder dynamism in the economy

The large cash piles built up by Japanese companies are, he says, a function of companies being very cautious following the crash of that country's economy and stock market in 1992, when they ran into huge debt, and have hoarded cash as a result.

He says despite the changes occurring in Japan, sentiment remains very negative, with global holdings of Japanese equities by exchange-traded fund investors presently at the lowest level since 2012.

New opportunities

John Paul Temperley, Japanese equity fund manager at Axa Investment Management, says companies strove to improve their balance sheets after the crash and “succeeded almost too well”.

He says investors looking at the country should view the lack of some types of consumer electronics on their shop shelves as a positive.

According to Temperley, the largest Japanese companies consciously moved away from the manufacture of low-margin items such as TV sets, and into areas such as gaming or robotics where the profits are greater.

He says in terms of the domestic economy, Japan lagged behind the rest of the world when it came to digitalisation, but has begun to catch-up.

Guillame Paillat, multi-asset investor at Aviva Investors, says that at the macro level, while Japan’s economic woes are well known by the market, it could be argued that the global economy is evolving in a way that is starting to resemble Japan.

If all economies begin to have the same characteristics, then the logical thing to do is buy the cheapest market, and that is Japan, he adds.

Paillat says: “Everyone else catches down to Japan, rather than Japan catches up. Japan has a very conservative culture and that can hinder dynamism in the economy.”

Joe Bauernfreund, manager of the AVI Japan Opportunity Trust, argues that the reputation of the Japanese market is not as bad as Europe but not as good as the US.

Bauernfreund says: "One of the reasons Japanese shares are so cheap is that perception issue – in other markets, if shares fall to very cheap levels, then someone comes in to buy it, but that doesn’t happen in Japan."

This is partly because of the perception, but also because, while in the UK, undervalued businesses get taken over by private equity companies, in Japan there are regulatory issues that block such takeovers.

He says this means “there are far too many” smaller companies on the Japanese market, but says this also means the smaller companies are the cheapest part of the market.

Chris Taylor, who runs the Liontrust Japan fund, cautions that the rights of minority shareholders in Japan remain far from ideal, but says the stagnant nature of the domestic economy prompted the export businesses of Japan to invest heavily abroad, making them more efficient.

The Japanese equity market is a beneficiary of incremental improvement in economic activity and profit growth driven by innovation

Global gazing

Temperley says the fates of the Japanese economy and equity market are heavily linked with that of the global economy.

He says: “The Japanese market does well when the world economy is expanding. It is very export oriented."

Pallait says the yen is a safe haven currency, so when people are optimistic about the world, it depreciates in value, which helps the exporters.

Taylor says: “Any post-Covid sustained recovery should favour the Japanese market, which remains firmly rooted at the lower end of global stock market valuation parameters.

He adds: "A major bearing on this outcome has been the relative sectoral split of the broad Japanese market as represented by the Topix index.

"Here, Topix's greater exposure to the clear beneficiaries of such a trend, namely the more cyclical/value industrials and consumer discretionary sectors, should underpin that market’s relative performance.

"By comparison the S&P 500’s high weighting in the clear pandemic beneficiaries, the information technology, healthcare and communication service sectors, accounted for that index’s much better returns since the end of 2019: 45.63 per cent vs 12.28 per cent.”

Nathan Sweeney is deputy chief investment officer of multi-asset at Marlborough, and presently has an overweight position towards Japanese equities.

He says that if we do get to a point where the market focuses less on growth because economic growth is already strong, and more on the valuations at which shares trade, then Japan, because it is a cheap market, would likely be one of the beneficiaries.

Sweeney adds: “We see other reasons for a positive view on the outlook for Japanese equities. The new prime minister, Fumio Kishida, is pushing through £370bn in stimulus packages, which will boost the economy.

"In addition, the Japanese stock market is starting to attract renewed interest from overseas investors, and we believe domestic investment is also set to increase, particularly among younger Japanese investors. Of the close to 500,000 new direct investors last year, 50 per cent were aged under 40.”

Inflation

Perry says there are also signs that inflation is, finally, coming to Japan after many decades, and inflation is generally positive for equities relative to bonds.

Melissa Brown, managing director for applied research at risk analytics firm Qontigo, says she regards the Japanese market as likely to be more volatile in the year ahead, because while Japan itself has had little inflation in recent decades, the economy and market suffers if the UK and US, as buyers of Japanese goods, are contending with higher prices.

The Japanese stock market is starting to attract renewed interest from overseas investors and we believe domestic investment is also set to increase, particularly among younger Japanese investors

Masayuki Kichikawa, chief macro strategist at Sumitomo Mitsui DS Asset Management, says some of the trends that have emerged in the western world in recent years, such as ageing populations and the rise of automation, are areas that Japan as an economy is ahead of those in the western world.

Meanwhile, the areas where Japan has historically lagged, such as in attitudes to remote working, are changing as a result of the pandemic.

Innovation

Shuntaro Takeuchi, portfolio manager at Matthews Asia, says: “For the past decade, the Japanese market has consistently outperformed European markets and even the Asia ex-Japan market, despite low GDP growth and low inflation.

"Why? In our view the Japanese equity market is a beneficiary of incremental improvement in economic activity and profit growth driven by innovation.”

He adds: “Labour populations are peaking in the US and China as the world [has started] facing issues that Japan has been facing over the last few decades. Baby boomers are nearing 70 years old and birth rates remain at record lows in almost all advanced economies.

"When you ask which companies have thrived amid a steady decline in labour force, ageing society, low birth rates, shrinking domestic demand and deflationary environment, the answer is growth companies in Japan.

"They have provided solutions to these structural challenges. Successful Japanese growth companies now have the opportunity to grow outside of Japan as these trends are starting to be felt globally.”

david.thorpe@ft.com

New PM, new dawn for investing in Japan?

Fumio Kishida inherits a much brighter situation than his predecessor as the state of emergency is lifted. Masaki Taketsume, fund manager Japanese equities at Schroders, looks at what this means for investing in Japanese equities.

Japan’s ruling Liberal Democratic Party has chosen its new leader.

Fumio Kishida, a former foreign minister, won the leadership contest and has become the new prime minister.

He is seen as something of a continuity candidate, fending off the challenge of Taro Kono, who some had perceived as the more dynamic, business-friendly option.

However, any differences between the two candidates are a question of nuance.

The change of PM has raised some concerns that Japan may be heading back into an era of political instability and short prime ministerial terms.

We do not see this as a particular worry.

After all, Shinzo Abe was Japan’s longest-serving PM (with his second term lasting from 2012 until 2020), so any subsequent incumbent was always likely to serve a shorter term in office.

Benign backdrop for Kishida

Abe’s successor, Yoshihide Suga, became PM only a year ago and immediately faced two major challenges: the Covid-19 pandemic and hosting the Olympics Games, with the former a serious complication to the latter.

The Japanese market is one where earnings momentum is still accelerating, compared to other regions

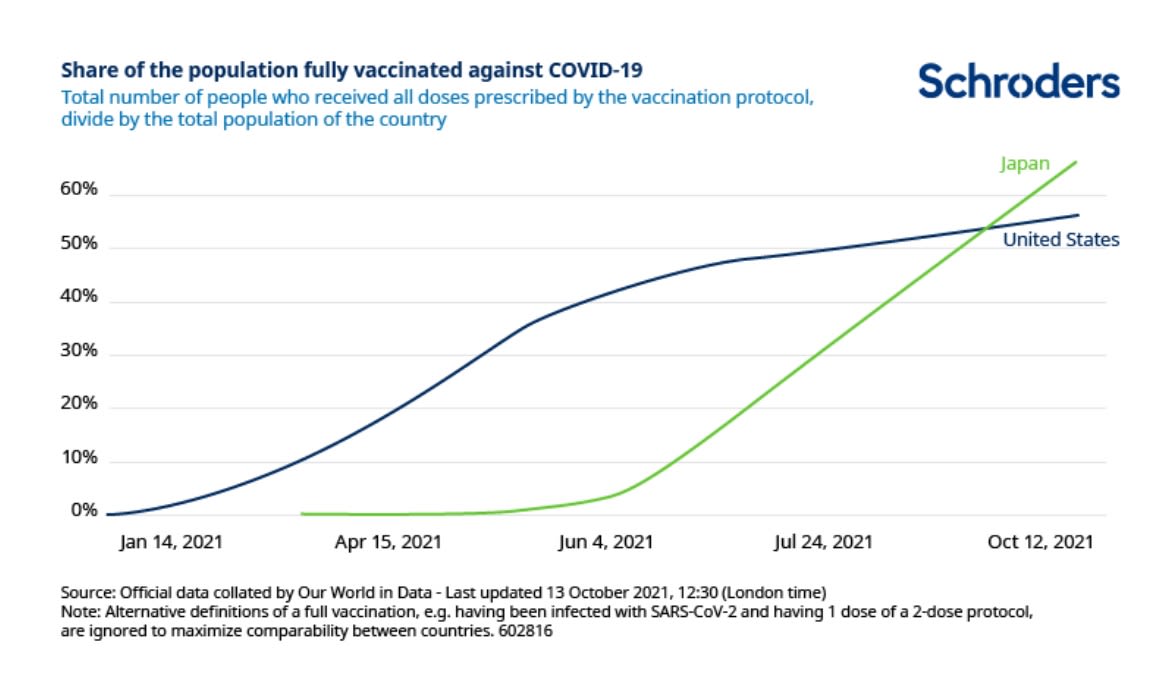

Public dissatisfaction with the slow roll-out of Covid vaccines in Japan was one of the primary reasons for Suga stepping down recently.

The slow pace of vaccinations combined with new waves of coronavirus to see successive states of emergency imposed on most of the country this year.

These weighed on domestic economic activity and also sent out an inconsistent message about the government’s priorities as the Olympic Games were held against the backdrop of a state of emergency in Tokyo.

However, the vaccination campaign has accelerated substantially in recent months. Japan has now fully vaccinated a larger share of its population than the US, despite a much slower start.

The pick-up in the pace of vaccinations means Japan was able to lift its state of emergency – which covered most of the population – at the end of September.

While Japan has benefited from the broader global economic recovery this year, we should now start to see the domestic economy reopen and recover.

Restaurants in certain areas still need to close relatively early, and some are restricted from serving alcohol unless they have certification for their anti-Covid measures.

However, domestic travel is now back on the agenda and large-scale events can go ahead with a greater number of spectators.

Domestic drivers to benefit small caps

We expect smaller companies in particular to benefit from this domestic reopening.

Small caps generally have much greater exposure to the domestic economy than their larger peers.

Companies operating in the service sector could now see stronger demand as travel, tourism, leisure and other consumer industries see demand and activity pick-up.

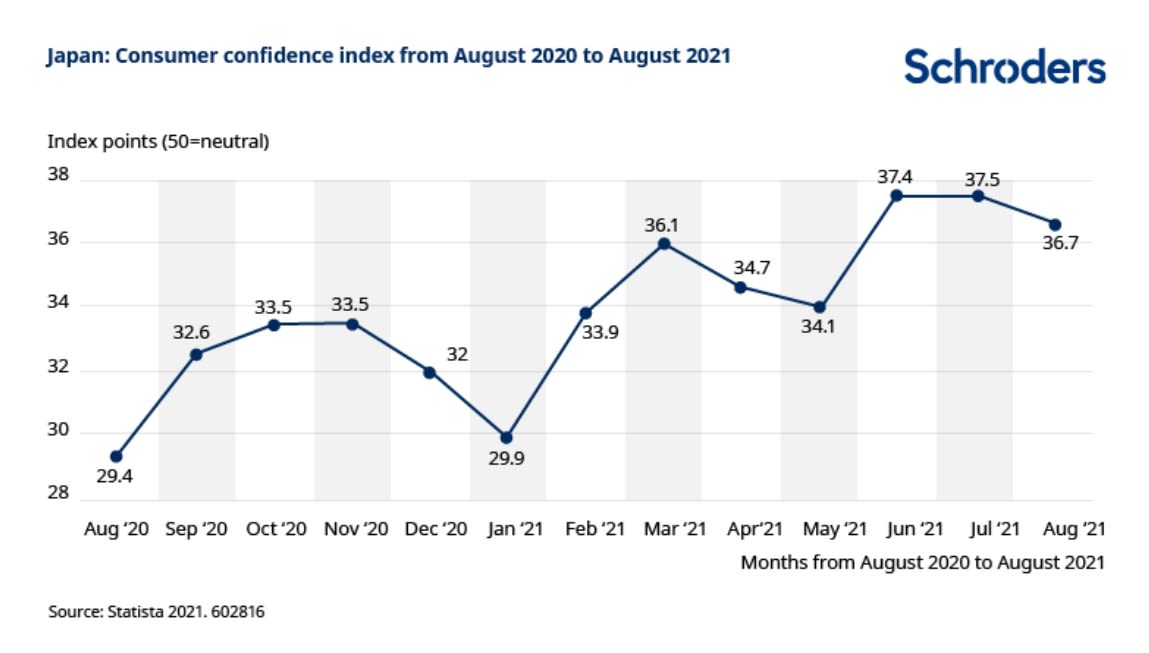

Japanese consumer confidence is gradually recovering, and this should bode well for companies exposed to the domestic consumer.

Small caps are a part of the market that we typically like, and many small caps are exposed to the domestic service sectors where we now anticipate a strong recovery.

As a long-term fundamental investor, there is often a greater opportunity to add value given how under-researched some of the companies are, compared with the larger Japanese companies.

Policy to continue, but environment rises up agenda

In terms of government policy under Kishida, we largely anticipate a continuation.

Japanese consumer confidence is gradually recovering, and this should bode well for companies exposed to the domestic consumer

The $490bn (£367bn) stimulus package unveiled in November will focus on additional support for those who suffered financially during the pandemic.

Climate change

One area where we have seen some change this year is on environmental issues.

Japan is among a number of countries that have pledged to reach net zero carbon emissions by 2050.

What is more, outgoing PM Suga also declared a more ambitious goal: that of cutting emissions in 2030 by 46 per cent relative to 2013 levels.

The debate about how Japan will achieve these targets look set to intensify.

Governance

We have already seen in recent years how governance factors have become more important and are being reflected in share price performance.

We anticipate a similar impact from environmental and social factors.

It is perhaps relatively early days, but we need to be prepared for potential changes in corporate and investor behaviour on these issues.

Overall, the Japanese market is one where earnings momentum is still accelerating, compared with other regions where upward revisions may have peaked as the chart above shows.

This corresponds to the path of Japan’s slower vaccine roll-out and longer-lasting restrictions.

The political noise around changes in prime minister should not distract investors from the brighter economic picture in the domestic Japanese market.

__________________________________________

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.